Should You Choose Conventional or SBA for Financial Advisor Loans

As mentioned in a previous post, financial advisors now have options when it comes to financing growth for their firm. Lenders have increasingly become more aware of the market and are developing loan solutions to match the needs of financial advisors. Those loan products typically fall into one of two buckets: conventional loans or SBA guaranty loans. Each loan type has different terms and conditions that advisors will want to consider before committing.

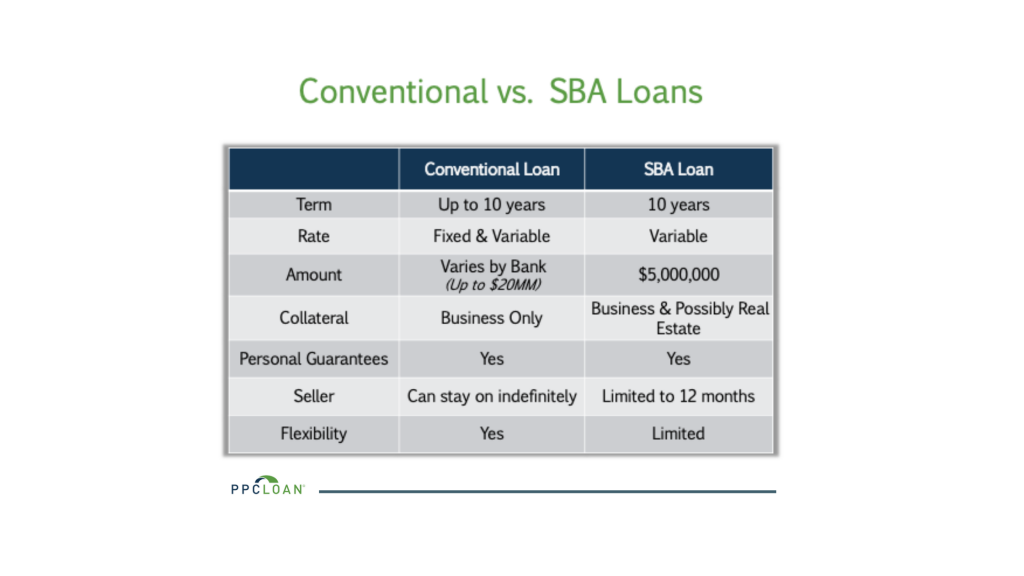

The chart below lays out the key differences between each loan type.

As the chart demonstrates, SBA loans have limitations when it comes to the many needs of financial advisors. Not only does the SBA have a maximum loan amount for a specific transaction or the total amount they can lend over multiple transactions, they also have limitations on the type of transaction that qualifies (i.e. buy-ins and partial equity purchases do not qualify for SBA loans).These limitations can impact an advisor or firm’s future plans if they have the need to do several acquisitions, bring on future partners/equity owners, etc. Lastly, because the seller cannot stay on for a period longer than 12 months, this can impact sell and stay scenarios for both external buyers and internal successions.

The biggest hurdle SBA loans present for advisors is in terms of flexibility since the program available accommodates all types of businesses, not just investment advisors. This typically differs from a conventional lender who will have designed a loan program specific to the needsof advisors which can evolve over time. Often, the nuances of different broker dealers and other regulating bodies can influence what is and isn’t allowed in terms of deal structure and the SBA’srigid guidelines cannot always be adjusted to meet the needs of a specific deal. Conventional loans, on the other hand, can be structured in a way that meets the needs of the deal, while providing protections for both the buyer and the seller.

The best thing for advisors to do is to shop around and learn more about what loan options are available. It’s also smart to engage a lender early on before agreeing to any terms, as the lender can educate the advisor on what terms the lender is willing to accept and which they are not. An experienced lender, such as PPC LOAN, can also identify challenges and red flags in a deal that could hurt the advisor. If you are looking at an acquisition or succession and would like to learn more about your options, you can contact us for a free consultation.