Impact of a Recession and Higher Interest Rates on Advisor M&A

Both practice values and advisor M&A activity have reached historic highs in the past few years. These rising trends were fueled by access to capital and an increase in education around equity management and M&A best practices. The disruption of the pandemic did little to impact this upward trend. Now, a sharp increase in interest rates and steady inflation have many worried a recession is on the horizon. Not only have these issues raised concerns about the economy, but it also has many advisors wondering about the impact these changes will have on advisory valuations and M&A activity.

In terms of valuations, all current indicators trend towards valuation multiples remaining stable. Valuationstake into considerationa number of factors that are used to determine practice value, but declining markets can put downward pressure on revenues and profit margins. This would lead one to assume the price would therefore be impacted negatively, butthe more evident shift has been a change in deal structure and a more balanced approach to risk sharing between the buyer and seller. While revenues and profits may be impacted, it doesn’t change the issue of an aging advisor force and the need for succession planning. Consequently, we don’t anticipate a significant break in purchase prices nor a material impact to the number of deals done annually.

As many know, the past few years have been a seller’s market, with a large pool of buyers competing for a small number of practices for sale. Greater access to capital and lower interest rates allowed many first-time buyers and smaller practices to enter the market. A steady and overall stable rise in the markets resulted in deal structures shifting most, if not all the market risk,to the buyers. Though it is arguably still a seller’s market,we believe that we are more likely to see changes to deal structure and not any material changes in valuation multiples.

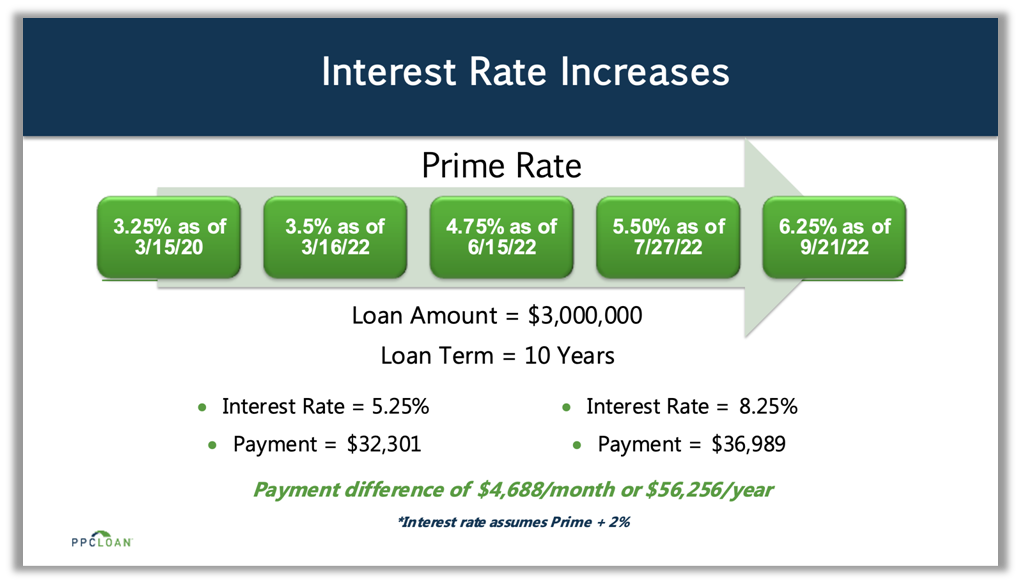

As the example below demonstrates, the higher interest rates are starting to have a higher impact on monthly payments. Although,it’s not dissuading buyers using traditional debt rather than private equity or some other form of capitalfrom pursuing good acquisition opportunities that have an immediate positive impact on profits.Revenue and profits aren’t the only reason buyers are seeking out acquisitions in this market.Many advisors have found acquisitionsto also be an excellent way to acquire much needed talent during the current labor shortage that all industries are experiencing.

External saleshave dominated headlines and overall activity continues to increase, but over the past few years we’ve seen internal successions become more common. Many internal successions aren’t reported in the M&A data provided by many industry firms. Within our own firm, the demand for Nextgen loans has increased by more than 30% over the last 18 months. We believe this trend will continue upward as Nextgen advisors have greater access to capital and both parties are becoming aware of the benefits and feasibility of phased successions.

Ultimately, we don’t anticipate a material change to M&A activity or valuations. The possibility of a worsening market and further interest rate increases could eventually be more impactful, but that’s yet to be seen. What we do know is that advisory businessesare resilient and the appetite for M&A will remain strong by well positioned buyers.