Fix Your Interest Rate!

History Predicts Rates to Increase by 5% over the Next 2.5 Years

May , 2015

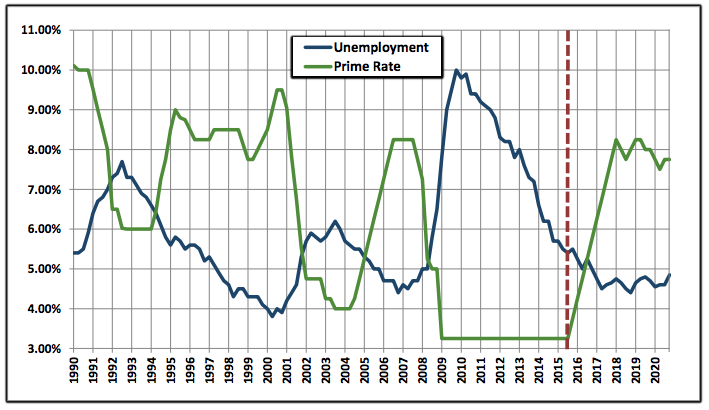

Don’t get caught in the rising tide. With unemployment rates dipping below 6% and showing no signs of stopping, experts say it is only a matter of time before the Fed begins taking steps to increase interest rates. Those with variable rate loans would be wise to lock in the current low market interest rates by refinancing with a long-term fixed interest rate loan product.

The charts below say it all. Historic interest rates have generally moved conversely with unemployment rates as the Fed balances economic activity to stabilize prices and moderate long-term interest rates. Since 1990, there have been two significant periods of increases in the prime interest rate as outlined below. In both instances, the prime rate increased significantly each quarter until reaching a level between 8% and 9%. If history repeats itself, we can expect the prime rate to increase by 5% over the next 30 months.

| Rate Increase | Time Period | Duration | Increase Per Qtr. |

|---|---|---|---|

| 3.00% | Jan ’94 – March ’95 | 15 Months | 0.60% |

| 4.25% | April ’04 – June ’06 | 27 Months | 0.47% |

| 5.00% | July ’15 – Dec ’17 | 30 Months | 0,50% |

With a 40%+ drop in the unemployment rate since 2010, and the unemployment rate already in the target range of 5-6%, most experts expect to see interest rates begin increasing in the late second quarter of this year.

A recent article in the New York Times stated:

“The Federal Reserve on Wednesday moved to the verge of raising interest rates for the first time since the economy fell into recession more than seven years ago… In a statement released after a two-day meeting of its policy-making committee, the Fed said that it would consider raising its benchmark rate as early as June, and it removed from the statement a promise that it would be “patient.”… [Yellen’s] remarks suggested that borrowers have a few more months to take advantage of exceptionally low interest rates on mortgages and car loans.”

- Locking in one of your largest expenses as a small business owner – your monthly debt payment. With so many variable expenses, certainty is certainly desirable.

- Dramatically reducing your monthly debt payment by extending your loan term to 10 years. Many have increased their free cash flow by as much $3,000 per month by extending their loan term. It is important to note that with PPCLOAN, you can always make additional payments to reduce your outstanding principal without penalty.

- Tapping into the equity of your Franchise by securing working capital to further grow your business through implementing new marketing initiatives, hiring additional staff, office expansions, etc.

For over 17 years PPCLOAN has consistently provided the most attractive financing programs available for small business owners across the country. With PPCLOAN you can expect quality service and tailored financing solutions for refinancing your existing business loan as well as for acquisitions (internal & external), mergers, partnership buy-ins and buy-outs, and succession plans. Put our knowledgeable and experienced staff to work for you and experience the difference!