The Affordability of Phased Successions

Internal successions have become more popular in recent years. They provide the Founders and Senior Partners with many advantages, including a smoother transition into retirement and the chance to groom their successors in a way that preserves their legacy. In previous years, it was more common to see a single succession eventwhere the seller who owns 100% of the firm exits quickly through an internal(or external) sale of 100% of their ownership interest. But overtime advisors have come to realize the challenges of a full internal buy-out and the benefits to both parties of doing a phased succession, most importantly the affordability of phased successions for the Junior Advisor(s).

The Challenges of a Full Buy-Out for Inside Buyers

Many Junior Advisors face significant challenges when it comes to doing a 100% purchase of the practice. Often Junior Advisors making their first move into the ownership role will lack the overall personal financial strength to borrow millions of dollarsand have no equity in the business itself to contribute towards the transaction. This presents several key hurdles for an advisor to overcome including:

- Tighter Cash Flows:Due to the increase in both the size of practices/firms and the increase in valuations, a majority of the distributions to the Junior Advisor will be committed to satisfying debt payments on the bank loan and/or seller note used to acquire equity/shares. This can create a scenario where there is limited excess cash-flow sufficient to meet the requirements for your typical loan requirements and approval.

- Difficulty Accessing Capital: As young professionals, most Junior Advisors aren’t positioned financially to borrow large sums of money from traditional lenders. In an internal transition,this limitationmay require theselling advisor to finance a larger percentage of the purchaseprice vs. working with an external buyerwho has the ability to offer more cash at closing. This leaves the Junior Advisor beholden to the selling advisor longer and puts the selling advisor into the role of financier. The selling advisor also must forgo a larger liquidity event that they could have realized with a lender financing more, if not all, ofthe purchase price.

- Difficulty Competing With External Buyers: External buyers with an existing book of business or established firmcan leverage their lendable equityand drive prices beyond the reach of an internal buyer with no equity or limited third-party financing to draw on. Furthermore, inside buyers cannot base price on their ability to create scale by way of acquisition.

How Phased Successions Improve Affordability for Internal Buyers

A phased succession, in which the Founder(s)transitions ownership to the Junior Advisor(s)by selling in tranches over a period of time, creates a win-win situation for both parties. Most of all, it creates an opportunity for the Junior Advisor(s) to steadily gain an equity position in the business and continue to build their personal financial strength over time. Specifically, phased successions:

- Improves Cash Flow: A phased succession improves cash-flow for the Junior Advisor both in the short-term and long-term as they are better able to manage debt payments by financing a lesser amount for their initial purchase. As the Junior Advisor pays down debt and earns more opportunities to acquire equity, they are able to take on more debt for future purchases.

- IncreasesWealth And Leverage: As the Junior Advisorsecures equity, they have the opportunity to create wealth by way of increased income and building a debt free equity position in the practice. This also puts them in a better position with third-party lenders who will see the Junior Advisor as more qualified with an equity stake and improved income to support debt repayment.

- Provides More Cash to the Seller: Phased successions can provide the seller with more cash over time without the need for them to provide seller financing. Often, the Junior Advisor helps to grow the practice and improve the value of the firm as well as profits, resulting in bigger payouts over time as additional equity is transferred from the Founder to the Junior Advisor. Sellers are more willing to sell equity when they don’t need to provide seller financing and when they can secure more cash at the close of each tranche sale.

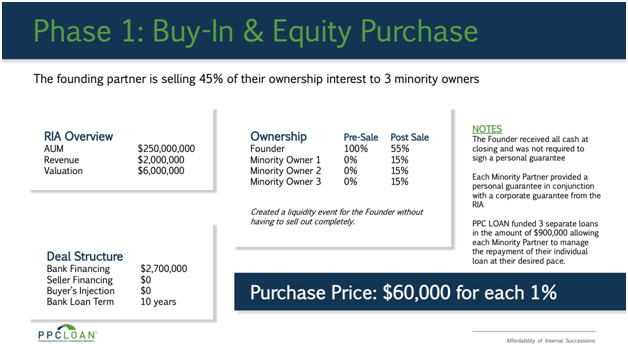

The example below demonstrates a phased succession. For the first phase of the sale, the founder transferred 45% of their ownership to three Junior Advisors.

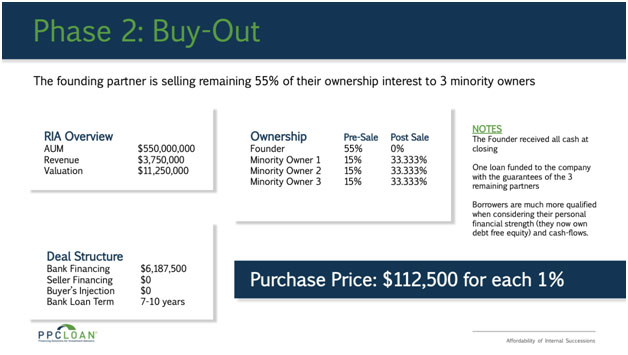

In the second phase of the succession(~7 years later), the owner transferred the remaining shares at a much higher valuation. This is the result of strong year-over-year growth which increased the overall value of the firm between Phase 1 and Phase 2.

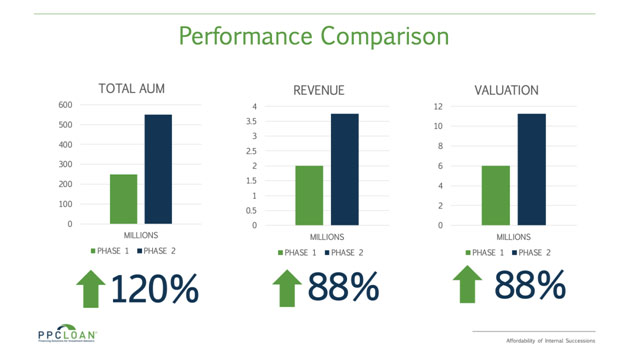

In the end, the practice saw tremendous growth thanks to the NextGen leadership. This resulted in a better final payout for the Founder, while maintaining affordability for the minority owners.

Overall, phased successions increase affordability for Junior Advisors while creating larger liquidity events and pay-outs for the selling advisor. They also lead to a more manageable transition for the advisors, who are able to slowly transfer the business over time making it a truly positive solution for all parties involved.