Refinancing Debt to Improve Cash Flow Ahead of a Recession

A steady increase in inflation coupled with slowing demand has many economists predicting a recession on the horizon. Fear of what challenges a recession might bring has many business owners, including financial advisors, looking at ways to strengthen their financial position to better weather any economic turmoil. While reducing expenses is one way to ease financial pressure, it’s not always that simple for an advisory business. Many advisors took advantage of historically low interest rates to refinance debt early in the pandemic. As interest rates have risen dramatically, many assume that it is no longer a viable strategy to refinance debt. However, refinancing debt can still significantly improve cash flow.

The Power of A Longer Loan Term

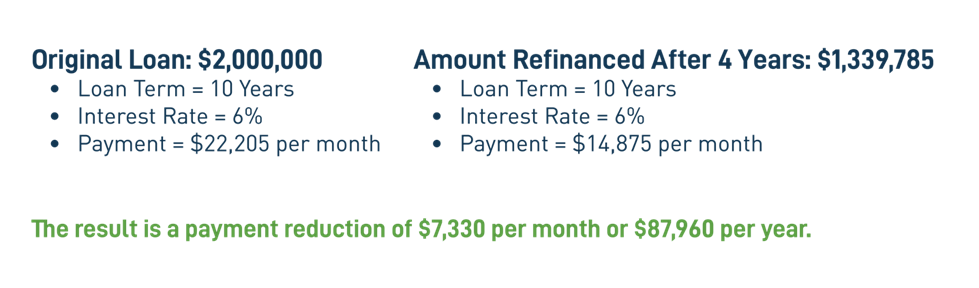

Most advisor loans that are secured for various needs include a ten-year amortization schedule. Advisors who are several years into paying down a loan can refinance and extend their payback period by several years. This allows them to reduce their monthly payment and in turn, improve cash flow. Advisors can also consolidate multiple loans, which may have different interest rates and terms, and realize a reduction in their monthly payments easing the debt burden ahead of any potential revenue slumps. The example below shows how refinancing, even with no change in interest rate, helped to reduce an advisor’s monthly payments for an acquisition loan.

Lock in a Fixed Rate and/or RemoveRestrictive Covenants

Other reasons to refinance could include locking in a fixed rate if your existing loan includes a variable rate or eliminating any covenants that can impact cash-flows over the long term (i.e. annual limitations on principal prepayment of the loan). The ability to maintain a predictable monthly payment will make it easier to manage cash flow when revenues and profits fluctuate. Having the ability to pay off debt early also allows advisors to reduce their debt obligation, should they have the means to do so, and free up commitments so they can use that money elsewhere.

As recession fears loom, it’s important for advisors to examine all avenues for improving cash flow. Refinancing to a longer term to reduce the monthly payment, lock in a fixed rate, or to remove restrictive covenants allows advisors to stabilize their debt obligation and gives them room to make other financial decisions about their practice. Refinancing may not be the right fit for every advisor, but it’s good to know that it is an option. Find out if refinancing is right for you. Contact us today.